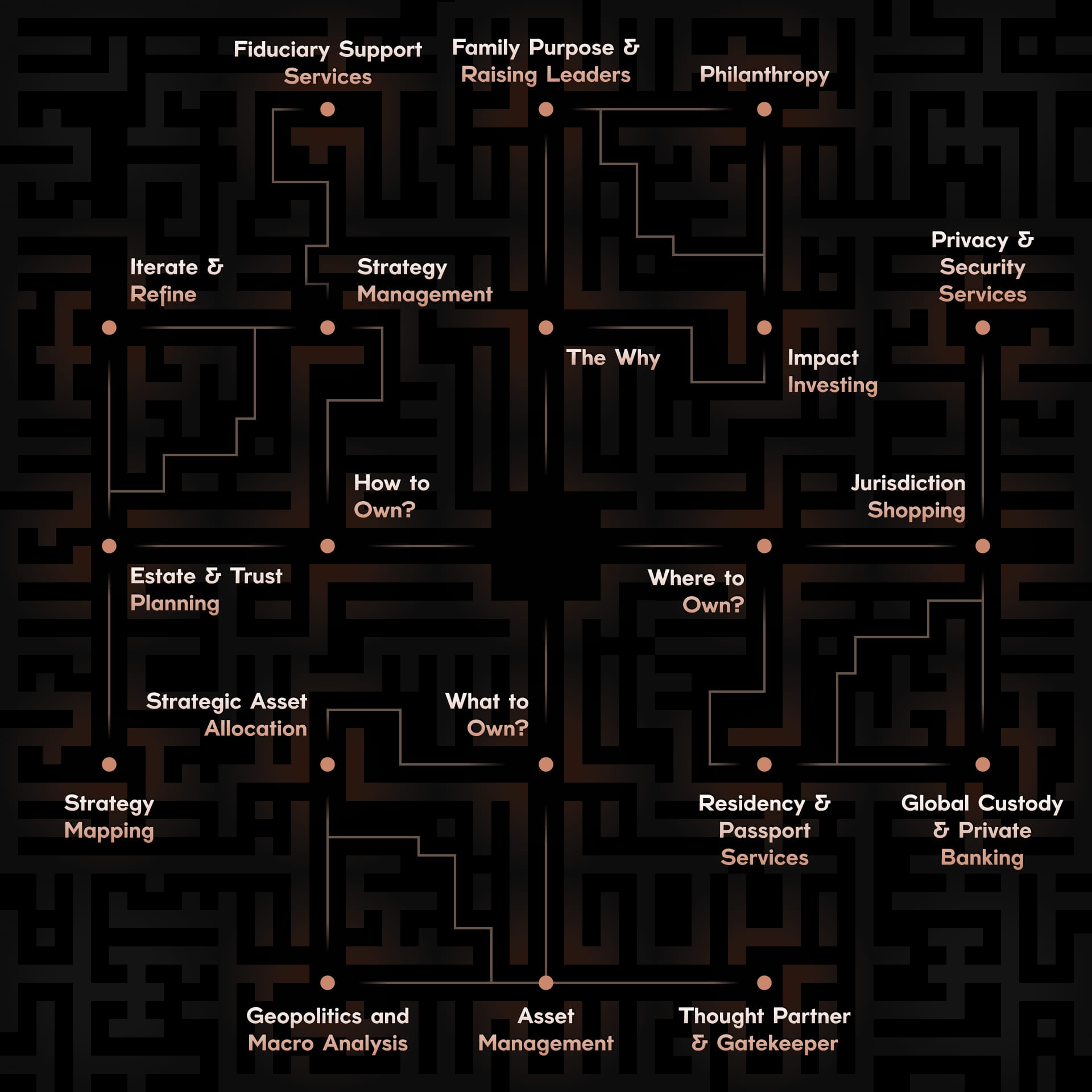

Yes. We provide strategic design and oversight for revocable and irrevocable trusts (SLATs, dynasty and offshore trusts, etc.), LLCs, private foundations, and other charitable structures to align control, protection, and tax efficiency. We help you allocate across revocable trusts, irrevocable trusts, and domestic and offshore entities based on your liquidity needs, control preferences, and tax objectives. The right structure supports your lifestyle today and protects legacy value long-term. While we do not draft legal documents, we have strong relationships with law firms and can provide strategic oversight to ensure your plan functions as expected.